55 Profitable Fortune 500 Companies Paid $0 in Taxes Last Year

Image Courtesy of The Washington Post

By Jeremy Perillo

According to a report by the Institute on Taxation and Economic Policy, fifty-five Fortune 500 companies paid $0 in federal corporate income taxes last year. This comes as the Biden administration is beginning conversations on tax reform.

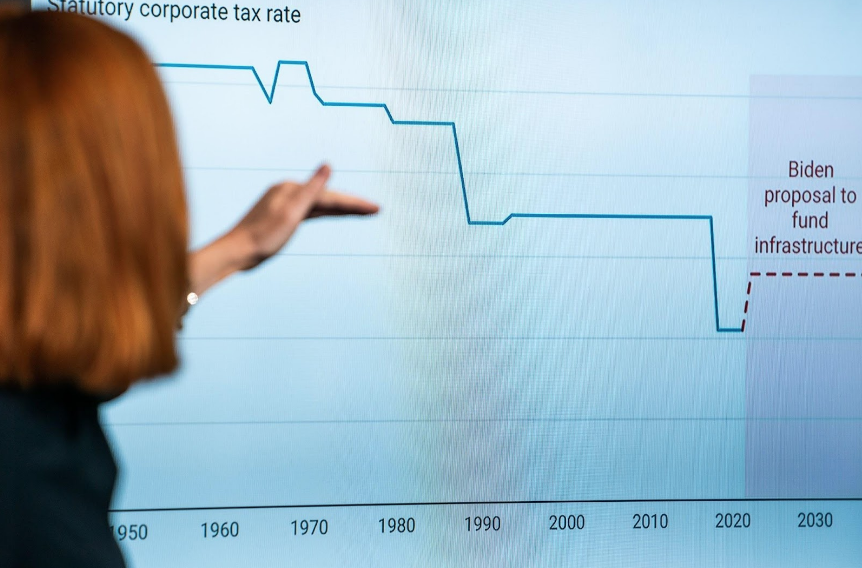

In 2017, Donald Trump’s tax bill swept through a Republican Congress and effectively lowered the corporate tax rate to 21 percent from the Obama administration’s 35 percent. On top of the low corporate tax rate, many companies also received tax rebates, which totaled $3.5 billion for these fifty-five companies, in addition to other legal deductions and exemptions.

The ITEP report determines that if the companies had paid the 21 percent tax on their profits, there would have been a collective $8.5 billion in taxes paid. Twenty-six of the fifty-five companies, including FedEx, Consolidated Edison, and Nike had avoided paying any federal income tax in the past three years. Nike and FedEx reported $2.8 and $1.2 billion in pre-tax income, respectively, over the last year alone.

Simultaneously, the Biden administration has been working with members of Congress, on both sides of the aisle, to push an infrastructure bill through Congress. As part of his plan to fund the $2 trillion piece of legislation, Biden has been seeking ways to gather revenue over 15 years, to fund this package.

Biden’s plan includes raising the corporate tax rate from Trump’s 21% to 28%, as well as enacting a minimum tax rate of 15% on large companies’ earnings, even with deductions and exemptions. When announcing his infrastructure plan, Biden directly referenced the tax dichotomy between average Americans and the world’s largest and richest companies.

“A fireman, a teacher paying 22% — Amazon and 90 other major corporations paying zero in federal taxes?” Biden said. “I’m going to put an end to that.”

Besides the typical rumbling from members of Congress, on both sides of the aisle, the response from business leaders has been mixed. The richest man in the world, Founder and CEO of Amazon, Jeff Bezos, has come out in support of increased corporate taxes.

“We support the Biden Administration’s focus on making bold investments in American infrastructure,” Bezos said. “Both Democrats and Republicans have supported infrastructure in the past, and it’s the right time to work together to make this happen. We recognize this investment will require concessions from all sides — both on the specifics of what’s included as well as how it gets paid for.”

Other business leaders, like Raytheon Technologies Corporation CEO Gregory J. Hayes, disagreed with Bezos’ warm perspective.

“As we look toward recovering from the COVID-19 pandemic, keeping competitive tax policies in place is needed to help reinvigorate the U.S. economy and lead to more opportunity for Americans,” Hayes said.

Biden’s attempt at altering the corporate tax rate, one of former President Trump’s biggest achievements while in office, allows him to kill two political birds with one legislative stone. Infrastructure is an area in Congress where there is generally large bipartisan support. If Biden can secure a large, long-term, and bipartisan infrastructure package, while at the same time altering the tax code, he will be able to finally demonstrate his ability to broker bipartisanship, as well as effective legislative leadership, as campaigns gear up for 2022.